rhode island tax table

How to Calculate 2020 Rhode Island State Income Tax by Using State Income Tax Table. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the.

Ri Democratic Party Ridemparty Twitter

Rhode Island Income Tax Rate 2020 - 2021.

. If your taxable income is larger than 100000 use the Rhode Island Tax Computation Worksheet. The state sales tax rate in Rhode Island is 7 but. 31 2021 can be e-Filed in conjunction with a IRS Income Tax Return.

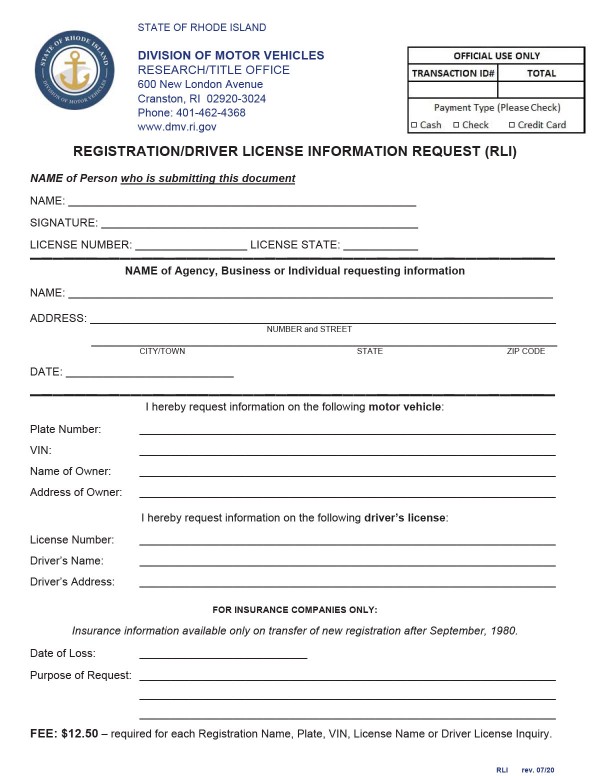

A Rhode Island employer must with-hold Rhode Island income tax from the wages of an employee if. Details on how to. Find your pretax deductions including 401K flexible account.

This page has the latest Rhode Island brackets and tax rates plus a Rhode Island income tax calculator. Download or print the 2021 Rhode Island Tax Tables Income Tax Tables for FREE from the Rhode Island Division of Taxation. This form is for income earned in tax year.

The 2022 state personal income tax. Latest Tax News. How to Calculate 2021 Rhode Island State Income Tax by Using State Income Tax Table.

Rhode Islands 2022 income tax ranges from 375 to 599. Less than 100000 use the Rhode Island Tax Table located on pages T-2 through T-7. Find your pretax deductions including 401K flexible account.

More about the Rhode Island Tax Tables Individual Income Tax TY 2021 We last updated the Income Tax Tables in January 2022 so this is the latest version of Tax Tables fully updated. Income tax tables and. Find your income exemptions.

Rhode Island State Income Tax Forms for Tax Year 2021 Jan. Before the official 2022 Rhode Island income tax rates are released provisional 2022 tax rates are based on Rhode Islands 2021 income tax brackets. Less than 100000 use the Rhode Island Tax Table located on pages T-2 through T-7.

2022 Filing Season FAQs - February 1 2022. The tax is 425 per pack of 20 which is. The Rhode Island Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and.

2020 Rhode Island Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. 2022 Rhode Island Sales Tax Table. Compare your take home after tax and estimate.

Masks are required when visiting Divisions office. Rhode Island Cigarette Tax Rhode Islands tax on cigarettes is the fourth-highest in the US. Across all states and the District of Columbia.

We last updated Rhode Island Tax Tables in January 2022 from the Rhode Island Division of Taxation. 2022 Rhode Island Sales Tax Table. PPP loan forgiveness - forms FAQs guidance.

Rhode Island state income tax rate table for the 2020 - 2021 filing season has three income tax brackets with RI tax rates of 375. One Capitol Hill Providence RI 02908. Find your income exemptions.

A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount. Compare your take home after tax and estimate. Rhode Island Division of Taxation.

EMPLOYEES FROM WHOSE WAGES RHODE ISLAND TAXES MUST BE WITHHELD. 2019 Rhode Island Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. More about the Rhode Island Tax Tables.

Rhode Island Income Tax Forms. If your taxable income is larger than 100000 use the Rhode Island Tax Computation Worksheet. Read the summary of the latest tax changes.

Estate Tax Ri Division Of Taxation

Historical Rhode Island Tax Policy Information Ballotpedia

Amazon Com College Flags Banners Co Rhode Island Pennant Full Size Felt Sports Outdoors

Rhode Island Llc How To Start An Llc In Ri Truic

Chicknic Table The Original Farmhouse Style Chicken Picnic Etsy Farmhouse Style Chicken Lover Gifts Farmhouse Style Table

Rhode Island Ri Tax Refund Tax Brackets Taxact Blog

Rhode Island Income Tax Brackets 2020

Rhode Island Income Tax Calculator Smartasset

Rhode Island Income Tax Calculator Smartasset

All About Bills Of Sale In Rhode Island Facts You Need In 2020

Rhode Island Property Tax Rate 1 5 Median Home Value 241 000 14th Highest Median Income 58 073 19th Highest Property Tax Property House Styles

Chart 2 Colorado Tax Burden By Type Of Tax Fy 1950 To 2016 Jpg Types Of Taxes Income Tax Chart

Free Rhode Island Boat Vessel Bill Of Sale Form Pdf

Prepare And Efile Your 2021 2022 Rhode Island Tax Return

Summertime In Burrillville Ri Round Lake Favorite Places Rhode Island

Rhode Island Income Tax Calculator Smartasset

Rhode Island Tax Forms And Instructions For 2021 Form Ri 1040